Here’s Issue #4 of The Hum, freshly thawed from the cold snap and the unstable polar vortex of the last few weeks.

In issue 3, we shared designs for sustainable instruments and music equipment, discussed Warner Music Group’s 10 year plan, and how magnetic tape played a key role in the evolution of listening.

In this issue we survey the innovations from CES that seek to change how music exists in our lives. In our history of portable audio series we enter the digital age of the compact disc. In a new series about the quantification, measurement, and monetization of music we dissect the song. Lastly we cover the recent ELVIS Act and the network of right of publicity regulations on a state and federal level.

Check our about page to learn about who we are and why we started The Hum.

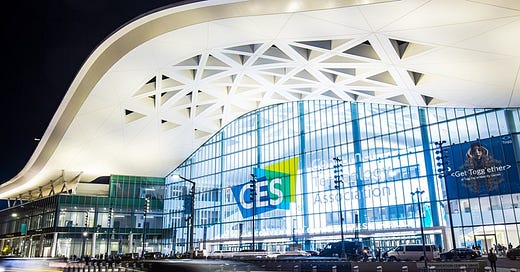

Music Tech at CES ‘24

While we did not attend CES 2024, we’ll share a few concepts from the trade show that sparked online discussion about how cool (or cringe-worthy) the future of consumer audio may be. Some designs emphasize music becoming invisibly integrated in our surroundings, while others centralize our connection to the listening device by drawing on our sense of nostalgia. If we look at each concept as a solution to a problem, what does it say about how we value music?

MBUX Sound Drive

Mercedes-AMG announced upgrades to their MBUX infotainment system, which include AI voice assistant, content streaming, an app to show off NFTs, and Sound Drive—indeed a “full tech bro” experience. Sound Drive, a collaboration between Mercedes-AMG and musician and entrepreneur Will.i.am, is a system that links music and driving by using “precise ‘in-car signals’ that enable the music to react to the driving characteristics in real-time.” The MBUX system is designed such that any musician can compose driving-based tracks, so finally you can tell people “you composed the windshield wiper beat.”

Fiio CP13

Fiio, a manufacturer known for making digital-to-analog converters (DACs) and other desktop audio equipment, announced the CP13 cassette player. Similar to Rewind, a company we mentioned in last issue’s portable audio series, the CP13 is bluetooth compatible. Despite the rise in cassette sales over the past few years, the cassette culture subreddit points out that the mechanism hardware has not necessarily improved since the 90s due to limited manufactures, nor does it differ from what Rewind offers. But, given consumer perception and costs to produce cassettes, does the cassette player need to improve?

LG DukeBox

In a similar nostalgic vein, LG shared a concept for the DukeBox unlikely to be produced. In theory the individual elements of this sound appealing: a modern day jukebox listeners gather around, the warm sound of retro vacuum tubes, and … a fireplace? But the DukeBox is actually composed of a 360-degree speaker, front facing speakers, vacuum tubes (unclear if they’re functional), housed within a transparent OLED casing which can display flames as well as other streamable media. Echoing Tech Radar, “nobody asked for this.”

Samsung Music Frame

Riding on the popularity of The Frame TV, Samsung announced the Music Frame, a WiFi/bluetooth speaker hidden behind a physical print that “seamlessly blends into its environment.” The Music Frame has been compared to Symfonisk, the speaker collaboration between Sonos and Ikea (also shared in our last issue). While the static art print can be easily swapped out, some reviews suggest the Music Frame is underwhelming next to its TV counterpart.

KiTBetter

KiT (Keep in Touch) Better, a product of South Korean company Muzlive that was a CES Innovation Award honoree, attempts to bridge the divide between physical and digital music through wireless album cards. The KiTBetter system includes a playback app where fans can wirelessly connect their physical album chips, an infrastructure for artists to share other media like videos and lyrics, as well as access to backend data for artists. While the concept seems like a crossover between HitClips and AirTags, the need for a listening format that favors the artist is not unreasonable given changes to Spotify’s payout model and Bandcamp’s repeat acquisitions.

Tracing the history of portable audio

In this series we explore how portable audio changed the way we listen to music enabling it to become ubiquitous, intimate, and easily shareable. Read more about why we choose to tell its story in our first issue.

In our last issue, we covered the history of cassette tapes, and how they set in motion the idea that music could be portable, shareable, and personalized. Today, we will share the next phase of this story, one which drove massive success for the music industry, but at a cost—the CD.

The Compact Disc: The last great physical format

The compact disc (CD) was first introduced into the market in Japan in 1982, after a successful collaboration between Philips and Sony. Philips mostly focused on the physical design of the disc, while Sony focused on the analog to digital conversion circuit design. The CD was based in part on the Laserdisc format, which had previously combined digital and optical technology for video playback.

While in development, the original diameter of a CD per Philip’s specification was 115mm, (which is the same length as a cassette tape measured from corner to corner) but in order to fit the longest performance of Beethoven’s fifth—a 74 minute 1951 recording conducted by Wilhelm Furtwängler, the decision was made by Sony VP Norio Ohga, to expand the format’s playback length to 74 minutes.

Over the first few years of CDs being in the market, their success was not certain. After a successful first year, both CD and CD player sales slowed down in 1983 and somewhat stagnated. Additionally, most major labels at first resisted the format, and were reluctant to invest in building new production plants and creating a new standard to replace the vinyl record, which at the time was a reliable standard.This led Sony to push for the commercialization of their portable CD player, the Sony D-5/D-50 in 1984.

As the first digital music format to gain mass market adoption, the CD capitalized on one of the cassette’s key features—its portability. It also improved on the format by allowing users to skip to songs, by expanding the playback length, and by being one of the first non-degrading mediums on the market (CDs do degrade, only at a slower rate).

By 1986, CD production had risen to 45 million per year, and by 1992 that number had risen to 300 million a year, surpassing the cassette as the most sold format in the USA. At their peak in the year 2000, nearly a billion CDs were produced in the USA alone and $2.5B globally.

By the late 90s, with the introduction of the CD-ROM format as a replacement to the floppy disk on computers, downloading audio files from a CD into a computer became quick and easy. The ability to copy files onto computers, burn CDs, the rise of file sharing platforms like Napster, and the rise of mp3 players like the iPod, spelled out the collapse of the CD as the prominent audio format.

CD sales began a precipitous drop in the early 2000s and continued to decline until 2023, when for the first time in over 20 years, the format saw a slight increase in sales. Similarly to recent vinyl and cassette comebacks, a rise in nostalgia from fans may be behind this increase in sales, although Taylor Swift’s 1989 Taylor’s version may have had something to do with it as well.

Overall, the CD was the music industry’s main format during its peak revenue-generating era. With CDs, portability didn’t have to come at the cost of reliability and sound quality (like the cassette), or as a tradeoff to size (like with vinyl). In the end, the CD set the stage for the digitization of music, which helped create ideal conditions for the next phase in the history of portable music: the mp3.

Metrics of Music

In this new series, we will explore how data is used across the music industry. Whether starting from a song, an artist, a label, or a listener, data is being created, analyzed, used, and monetized across the musical landscape.

Part one: The song

Songs today are surrounded by data and in some ways, songs themselves are data. From the time music started being written, data has been collected about musical pieces to understand their content, their appeal, or their success with audiences.

As AI enters the music industry and streaming continues to grow as the primary mode of consumption for music, data has become a key element of how music gets distributed and consumed. Let’s take a deeper look into the types of data hidden within a song, and how each of these data types is being utilized today.

The data behind a song can generally be classified into four main categories: track data, rights data, performance data, and financial data. Each of these can consist of hundreds of individual data points, but generally they work as follows:

Track data consists of the information about the song itself, its writers and producers, and its context. Data in this category can be further split into two main groups, factual and descriptive data.

Factual data consists of objective information about the track—who the songwriters are, the track’s title, its release date, the staff that worked on it, the label that released it, the BPM, time signature, and key of the song.

Descriptive data consists of the acoustic and artistic qualities of the track. These often include the mood, genre, voice, energy, and danceability of the song.

Track data is necessary to make sure that music can be organized and found. It is also behind the recommendation algorithms of most streaming platforms. Additionally, issues with track data oftentimes result in performers, artists, or staff, losing out on opportunities and income.

Rights data includes all the data related to ownership over a song. Considering that many songs have the same name, the industry has created a series of codes that are used to identify individual tracks, these include the International Standard Recording Code (ISRC), and the International Standard Work Code (ISWC), among others.

Without rights data, it would be impossible for anyone to get paid. Rights data helps DSPs, distributors, labels, and anyone else involved in the value chain of music to direct their share of revenues to the right parties.

Performance data consists of data about a song generated by the users and the environment around the song. It can usually be split into two main categories:

Consumption data: This data is usually collected by streaming platforms and it consists of the number of plays, saves, listeners, shares, etc. that a track generates.

Audience data: This data determines how a particular song performs within different audience groups (age, race, gender identity, location, etc.)

Performance data usually flows back from users to creators, since it wouldn’t exist without them. Performance data is utilized by artists, labels, DPSs, and distributors to measure how any given song does within a market and audience group.

Financial data includes the sales and revenue generated of a track (usually across physical and digital formats) and any additional attributable income generated by a track, like sync revenues, or ad revenues. This data is usually proprietary to labels and copyright owners and not widely available.

Financial data is one of the main inputs to music charts, where the physical and digital sales, along with streams are factored to create the top lists of songs and artists at any given time.

Many businesses exist around these data categories, for example Discogs has created one of the largest databases of factual track data, providing detailed information about millions of tracks, albums, and artists. Other platforms focus entirely on a single type of data—Musixmatch has built an entire business by creating a database of lyrics that can be embedded into other apps. If you’ve ever read a lyric in Spotify, it’s thanks to them. Distributors like Distrokid, CD Baby, and Tunecore make sure that all the track and rights data uploaded to their platforms is complete and accurate, and also act like data intermediaries for performance data flowing back to artists.

As streaming platforms and the music industry’s use of social media and AI continue to grow, the ownership and strategic use of data will increasingly become a key advantage for companies in the space. Those with thoughtful collection, analysis, and use of data will be able to better understand their audience, plan their live events, and capitalize on trends, while those without it will flounder. Today data is already a central part of how major labels and streaming platforms operate, and in the future it may change how and which music gets made.

Protecting the voice

Earlier this month, Tennessee Governor Bill Lee announced the Ensuring Likeness Voice and Image Security (ELVIS) Act, protection for songwriters, performers, and other music industry professionals’ voice from AI misuse such as computer-generated recordings and deepfakes. As neither voice nor AI-generated art can be copyrighted, many lawmakers aim to establish the right of publicity to protect the interests of the person(s) who may be the subject of the work.

Several states have passed protections against unauthorized use or likeness of one’s voice, but the policies have manifested differently based on scope, the policies written more broadly receiving criticism for overregulation. In some states voiceprint is included as part of biometric information privacy policies, however Illinois is the only to enable a private right of action. California has focused their scope to protecting against unauthorized access to and processing of personal information, largely that of consumers, through the California Consumer Privacy Act (CCPA) and with forthcoming regulation of automated decision making technology (ADMT) which includes AI. In comparison, Tennessee has narrowed their focus to the music industry, gaining the support of SAG-AFTRA, ASCAP, BMI, and other entertainment groups.

On a federal level, the bipartisan bill No Artificial Intelligence Fake Replicas and Unauthorized Duplications (No AI FRAUD) Act, which attempts to further establish right of publicity, has been backed by the Recording Industry Association of America (RIAA), Human Artistry Campaign, and Universal Music Group. While this bill falls within the same domain as President Biden’s executive order on AI last fall, the executive order still relies on applicable guidelines to be further fleshed out—as well as consumer trust to be garnered—before impact is seen. The 2024 election may prove to be a test of AI’s current guardrails as the fear of misinformation and the influence of deepfakes are at an all time high, and liar’s dividend looms.